The Department of Finance of the Canton of Zug recently published the adjusted interest rates for late payment, refund and compensatory interest on cantonal and communal taxes for 2024. From 2024, the Canton of Zug will also once again grant a discount for early tax payment. We have summarized the most important information for you below.

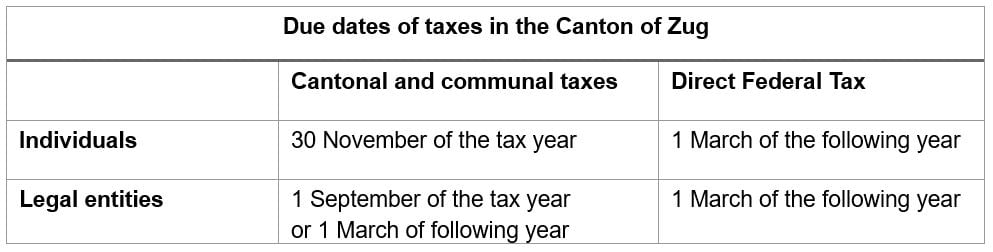

Cantonal and communal taxes for individuals in the Canton of Zug are due on November 30 of the relevant tax year, while direct federal tax is due on 1 March of the following year.

If a legal entity closes its financial year in the first half of the year, the cantonal and communal taxes of the Canton of Zug are due on 1 September of that year. If, on the other hand, the accounts are closed in the second half of the year, the due date is 1 March of the following year. Direct federal tax is due on 1 March of the following year.

Below is a summary of the due dates:

The deadline for payment for provisional tax invoices is 30 days.

The payment of taxes before or after the due date or the late payment of a tax bill can have interest consequences for cantonal and communal taxes or direct federal taxes.

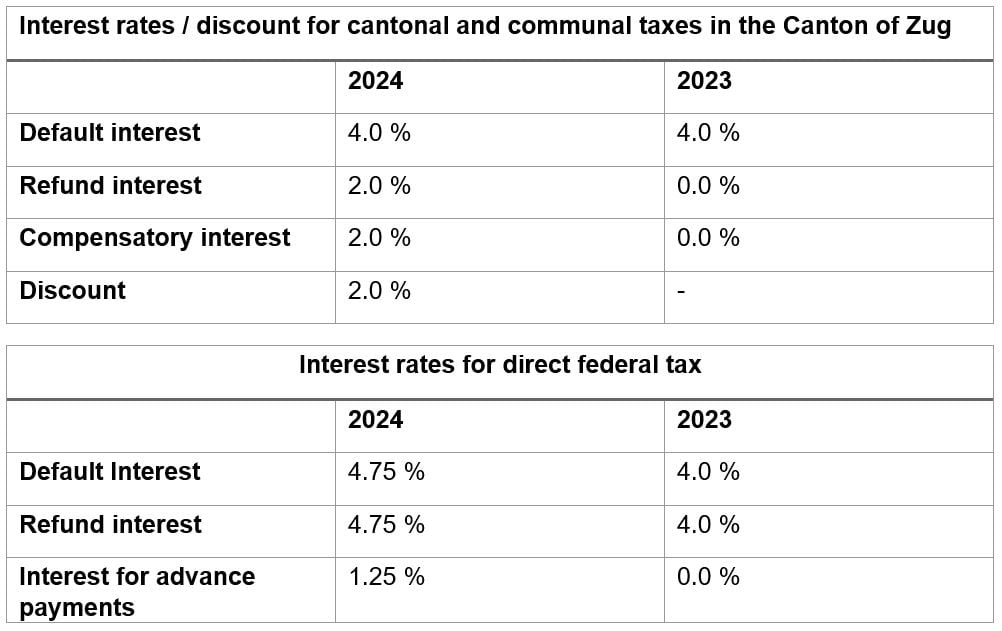

Default interest is owed if the taxpayer fails to pay a provisional or definitive tax invoice within the payment period of 30 days. For 2024, the default interest rate remains at 4.0 % in the canton of Zug.

However, if a taxpayer pays too much tax by mistake or on the basis of a provisional, definitive or contested assessment, the overpaid amount is refunded, and interest is owed from the date of payment. The canton of Zug will raise the corresponding refund interest rate from 0.0 % to 2.0 % from 1 January 2024.

Compensatory interest is owed on a potential additional claim if the final tax invoice is issued more than one year (individuals) or more than six months (legal entities) after the original due date. The compensatory interest is calculated on the basis of this additional claim for the time period beginning six months or one year after the original due date until the final invoice is issued. Compensatory interest in the canton of Zug will rise from 0.0 % to 2.0 % from 1 January 2024. However, if the final assessment is lower than the amount provisionally paid, there is no positive compensatory interest in the canton of Zug. If the provisional tax bill proves to be too high, the refund interest is applied.

If an individual pays their full annual provisional tax by 31 July of the current tax year, they will receive a discount of 2.0 % for the respective tax period (from 2024 onward). Legal entities cannot benefit from this tax discount.

The Federal Tax Administration (FTA) has also adjusted the interest rates for direct federal tax from tax period 2024 onwards. The default and refund interest rates are now 4.75 % instead of 4.0 %. The interest rate for advance payments will be increased from 0.0 % to 1.25 %. There is no discount for direct federal tax. Compensatory interest is also only available at cantonal level.

In connection with direct federal tax, default interest is charged if a tax claim or fine is not settled within the payment period of 30 days.

If the tax amount based on a definitive assessment is lower than the amount paid by the taxpayer based on the provisional assessment, the overpaid amount will be refunded. Interest is paid on this amount from the date of receipt of payment (refund interest).

At federal level, interest is paid on instalments and other advance payments from the date of receipt of payment until the due date. If there are credit balances resulting from voluntary payments by the taxpayer, these are also subject to the refund interest for advance payments after the due date.

Do you have any questions? Our tax team will be happy to help you.

Source: https://zg.ch/de/steuern-finanzen/steuern/steuerbezug/zinsenskonoto