Read in our article about changes in the field of social security and professions subject to registration in 2021.

1.1 New Contribution Rates EO

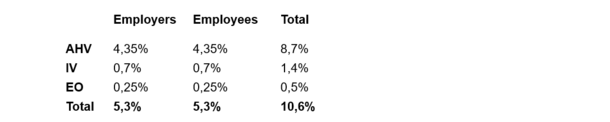

On 27 September 2020, the Swiss voters approved the introduction of paternity leave. The amendments to the Loss of Earnings Compensation Act (EO) became effective on 1 January 2021. As per this date, the EO contributions for employers and employees also increased from 0.225% to 0.25% each.

From 1 January 2021, the following contribution rates are applicable:

Further helpful information can be found on the website of the Federal Social Insurance Office FSIO (information only available in German).

1.2 Entry Threshold Occupational Pension

The entry threshold for compulsory insurance in the second pillar is now at an annual salary of at least CHF 21,510. A person must earn as much as this salary working for an employer in order to be compulsorily insured under the BVG.

Further helpful information can be found on the website of the Federal Social Insurance Office FSIO.

1.3 Social Security - International

Employees working in Switzerland are usually covered by the Swiss social security system, even if they have no residence in Switzerland. In the case of employees working across borders, the question arises as to where they are insured. The following principle applies: if employees carries out a substantial part of their work in their country of residence (at least 25%), they are likewise insured there. This also applies if the employee works from his foreign home office.

However, due to the exceptional circumstances related to the coronavirus, this 25% rule is currently applied flexibly. This means that an employee remains subject to the Swiss social security system even if he or she is currently working in a home office abroad. This flexible application is expected to last until 30 June 2021. However, as soon as the health situation normalises, the usual subordination rules will apply again.

Further helpful information can be found on the website of the Federal Social Insurance Office FSIO (information only available in German).

Employers are obligated to report jobs in occupations with a national unemployment rate of at least 5% to the Employment Center (RAV). The list was expanded by additional occupational types compared to the previous year due to the Corona crisis. Many of the new occupational types that must be reported are in the hospitality, retail, aviation, tour operator and manufacturing sectors.

The list of occupations subject to registration for 2021 and other useful information can be found on the work.swiss website.