Swiss financial market players who intend to launch a dark green fund pursuant to Article 9 SFDR must be aware of the farreaching disclosure and transparency obligations. Thus, disclosure obligations must be observed at the level of the company as well as at the level of the product. In this context, the Swiss financial market player cannot shift these obligations to the management company domiciled in the EU but must regularly disclose the relevant information itself on its website.

1. Introduction

1.1. Green Deal and Greenwashing

Since the EU Commission launched the "Green Deal" in December 2019, the attention regarding ESG has not only been increased on a political level, but a real trend has emerged to promote oneself as a company or product as sustainable. In the financial industry, there are now numerous "sustainable" or "ESG" investment products that promise an investor a sustainable and ESG-compliant investments – however, this is not always true: The term greenwashing refers to the phenomenon whereby companies or investment products present themselves as sustainable, but do not act accordingly or the money is not really invested sustainably with the corresponding investment product.

1.2. Combating greenwashing

In particular, to counteract greenwashing and to better compare financial products, the EU Commission has adopted the Sustainable Finance Disclosure Regulation (Regulation 2019/2088) ("SFDR"), which imposes far-reaching disclosure and transparency obligations on financial market participants and financial advisors. Financial market participants and financial advisors must also comply with the EU Taxonomy Regulation (Regulation 2020/852) ("EU Taxonomy"), which supplements the SFDR, in particular if their products advertise environmental or social features (Art. 8 SFDR) or if the products invest in an economic activity that has been declared an environmental objective (e.g. if sustainable investments within the meaning of Art. 2 No. 17 SFDR are sought (Art. 5 EU Taxonomy)).

1.3. Main factors of the SFDR

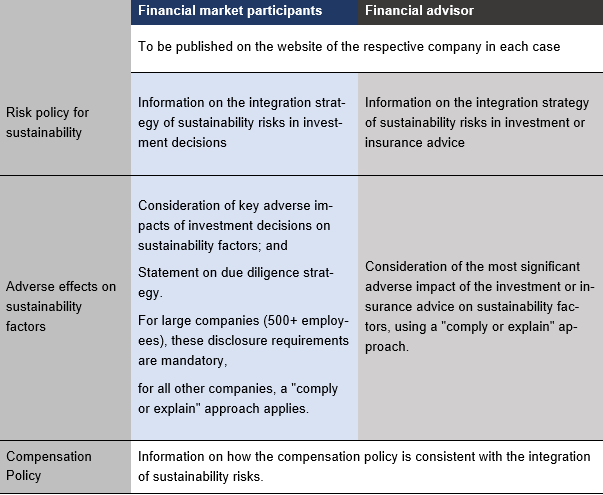

The SFDR distinguishes between disclosure and transparency obligations at the company and product level on the one hand, and three product categories on the other:

The following is a clear overview of the obligations Swiss financial market players must observe if they intend to launch a Dark Green fund.

2. Applicability of the SFDR to Swiss financial market players

2.1. Exception: Exclusion of Swiss financial market players

The SFDR is an EU regulation and therefore binding and directly applicable for all EU member states. For Swiss financial market players, this primarily means that they are excluded from the scope of the SFDR. This applies absolutely if a Swiss financial market player neither maintains client relationships with EU persons, promotes its products to EU persons nor offers products in an EU member state.

2.2. Rule: Inclusion of Swiss financial market players

However, due to the interconnectedness of the financial markets, the aforementioned exclusion only applies to a handful of Swiss financial market players. In the fund industry in particular, funds (collective investment schemes) are not set up under Swiss law for tax reasons. Instead, Swiss financial market players set up funds primarily under Luxembourg or Liechtenstein law in order to benefit from tax advantages, faster launching (keyword "time-to-market") or to profit from the attractive product selection (e.g. favorable regulation).[1] With such an "EU product", Swiss financial market players are subject to the applicable rules of EU law.

2.3. Typical structure

Such EU products require a management company or an alternative investment fund manager (AIFM), which has its registered office in the respective country of incorporation of the fund. This management company delegates the essential management activities (e.g. portfolio management) to the "initiator" or "sponsor", i.e. to the Swiss financial market player, which gives the latter control over the fund.

3. Unique selling proposition "Dark Green Fund"

3.1. Dark Green Fund is not a legal form

The product categories mentioned above do not refer to the legal nature of the investment product but categorize its pursued or advertised investment objectives. Thus, a Dark Green fund can assume any permissible legal form and be set up accordingly as an open-end fund, e.g. as an FCP, or as a closed-end fund, e.g. as a SICAF.

3.2. Unique selling proposition

The sole purpose of a Dark Green fund or Article 9 product is to achieve a predefined sustainability target. Sustainability thus drives the investment approach for Dark Green funds while ensuring that no other sustainability objective is significantly compromised. At the same time, the SFDR requires Dark Green fund providers to apply good corporate governance practices.

Only about 3.6% of European funds meet the requirements of a Dark Green fund. Accordingly, "Dark Green" is a label that on the one hand allows providers to cleverly market their product. On the other hand, it allows investors to find a truly sustainable product at first glance and thus to set the desired "impact".

3.3. Distinction between "Dark Green" and "Light Green" funds

Light Green funds also pursue environmental and/or social objectives, but - unlike Dark Green funds - not exclusively, but "only" alongside other non-sustainability-related objectives. Accordingly, it is possible to provide a product with an exclusion list in order to label it as a Light Green fund. This exclusion list can, for example, list the industries or countries in which the product does not invest because they are not compatible with the "do no harm - principle".

What light and dark green funds have in common is that the defined and pursued sustainability goals must be measured with "sustainability indicators". These sustainability indicators must be disclosed so that the public can understand how the impact of the product is measured.

4. Disclosure obligations for Swiss financial market players in

connection with Dark Green funds

As mentioned above, the SFDR distinguishes between disclosure and transparency obligations at the company and product level. Swiss financial market players are interested in which obligations they personally face when they launch an EU investment product. The question arises as to whether a distinction can be made between obligations that affect the management company and obligations that affect the Swiss financial market player as initiator or sponsor. These obligations are now to be discussed.

4.1. Disclosure of adverse sustainability impacts

4.1.1. At the corporate level

According to Art. 4 SFDR, both financial market participants (those offering a Dark Green fund) and financial advisors (those advising on a Dark Green fund) must provide information on their website about the main adverse impacts of investment decisions on sustainability factors. However, with respect to the content of this disclosure requirement, the requirements for financial market participants and financial advisors differ:

4.1.2. At product level (for Dark Green funds)

At the product level, the SFDR also provides for disclosure requirements with regard to sustainability. In addition to ESG-related products, this also affects conventional and thus non-ESG-related products. These are not considered here. The following refers to Dark Green funds regarding a) pre-contractual information obligations, b) regular (annual) reporting, and c) disclosure obligations about the product on the website.

a) Pre-contractual information obligations

Both financial market participants and financial advisors must disclose prior to the conclusion of the contract (usually in the prospectus or (basic) information sheet):

Further, financial market participants, but not financial advisors, must provide information prior to the conclusion of the contract as to which important adverse effects the product has on the sustainability factors or explain why it does not have any important adverse effects.

In addition, it must be stated by means of a specified template as an annex to the prospectus/basic information sheet how the sustainability target pursued is to be achieved and how the specific index for measuring the impact on the target is aligned.

The regular reporting requirements can be summarized as follows and are also partially included in the EU taxonomy:

Conclusion

Depending on how the framework agreement between the Swiss financial market player and the EU management company is structured or depending on which tasks are delegated to the Swiss financial market player, it must either comply with the obligations regarding financial market participants or financial advisors.

If the Swiss financial market player distributes the Dark Green fund itself, advertises it in the EU or makes the product available for purchase by EU persons, it is deemed to be a financial market participant. If the Swiss financial market player only manages the portfolio, i.e. if the investment decisions are de facto left to the management company and if the Swiss financial market player limits itself to advising the management company, it must comply with the disclosure requirements for financial advisors.

Apart from the information the Swiss financial market player has to disclose on its website, the EU management company will generally require the Swiss financial market player to also provide the information the EU management company has to disclose on its website. Thus, a Swiss financial market player must provide the information to financial market participants and financial advisors.

________

[1] Switzerland has recognized this competitive disadvantage. Accordingly, the Limited Qualified Investor Fund (L-QIF) is expected to come into force on 01.08.2023 and offer competition to foreign products.